Company Overview

The Development of Investment in the Cryptocurrency Market

M1 Finance, founded in 2015 and headquartered in Chicago, employs a team of 75. Its core business encompasses securities investment, margin lending, cash management, and investor education. M1 Finance is committed to reshaping the personal financial ecosystem and guiding investors toward long-term, buy-and-hold investment strategies.

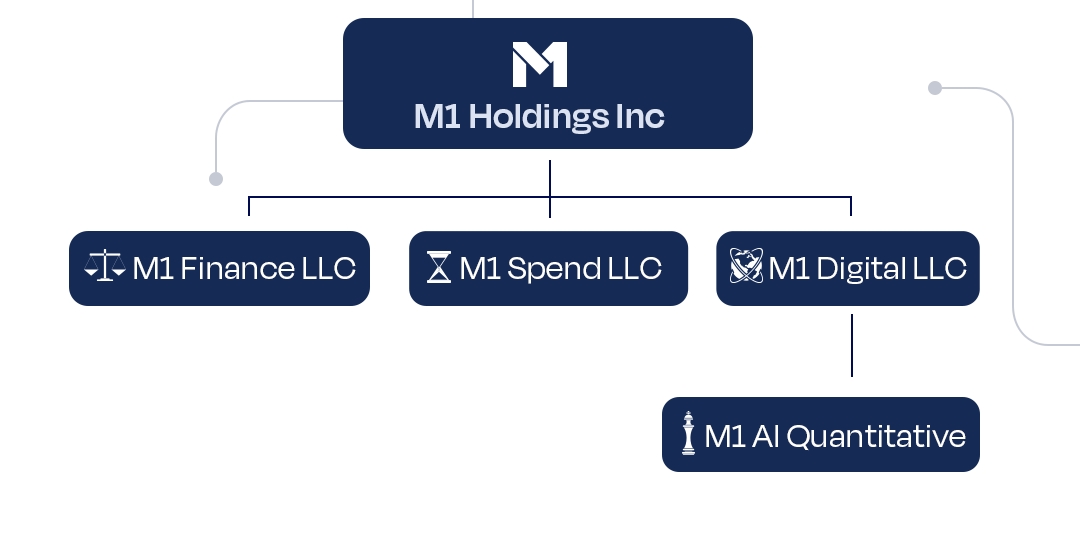

In July 2022, M1 began investing in cryptocurrencies and established wholly-owned independent subsidiaries: M1 Finance LLC, M1 Spend LLC, and M1 Digital LLC, focusing respectively on finance, payments, and data as their core businesses. In November 2024, M1 Digital LLC took the lead in the M1 project and launched the M1 AI Quantitative Robot, aiming to create an innovative investment platform that integrates blockchain and artificial intelligence.

Our Mission

Integrating successful trading models between centralized finance (CEX) and decentralized finance (DEX), leveraging advanced artificial intelligence and deep learning technologies to develop unique quantitative analysis systems and trading strategies. By utilizing smart contracts and cross-platform trading, we aim to achieve high returns with low risk in investments.

M1-AI is dedicated to building a decentralized, open, inclusive, and free financial system, enabling true cross-platform interoperability and providing inclusive financial services for everyone. Our project has received support from top-tier venture capital firms and mainstream exchanges, steadily advancing the development of the global fintech ecosystem.

Our Vision

Based on investment banking principles and intelligent advisory, with artificial intelligence technology at its core, the quantitative trading model is built on big data. It aims to provide investors with a high-value, secure, and reliable investment product, delivering stable long-term returns.

Value factors can bring attractive long-term returns, but they inevitably come with challenging periods that can be painful for investors. However, the subsequent economic recovery often proves profitable for those who stay the course. M1 AI Intelligent Custody helps investors overcome emotional distress during difficult times, enabling them to achieve long-term value returns.

Looking back, the low expected returns of many asset classes have not undergone significant changes. By relying on M1 AI Intelligent Custody's flexible and real-time compound strategies, these issues can be effectively addressed.

Big data indicates that the net losses achieved by direct index loss-harvesting strategies gradually decrease in the initial years after implementation. Additionally, these strategies exhibit highly diversified net loss outcomes. Therefore, factor-based long-short strategies driven by M1 AI Intelligent Custody can significantly outperform direct indexing strategies.

Last updated