Market Background

The cryptocurrency market began with the birth of Bitcoin in 2009, with the aim of providing a decentralized payment method. As blockchain technology developed, cryptocurrencies gradually evolved from being mere payment tools into a new asset class, attracting the attention of investors worldwide.

The launch of Ethereum in 2015 further accelerated the development of the cryptocurrency market, providing the infrastructure for decentralized applications (DApps) and smart contracts. Today, the cryptocurrency market has expanded beyond Bitcoin and Ethereum, encompassing various sectors such as stablecoins (e.g., USDT), decentralized finance (DeFi), non-fungible tokens (NFTs), and Web3.

As of 2024, the total market capitalization of the cryptocurrency market exceeds $1 trillion, with BTC and ETH dominating the market, accounting for approximately 60%-70%. The market has attracted broad participation from retail to institutional investors. In recent years, institutional investors, such as Fidelity and BlackRock, have entered the market through ETFs and custodial products, further driving market maturity. Amid the ongoing development of the crypto market, a quantitative revolution has quietly emerged.

The Rise of Quantitative Trading

Against the backdrop of the digital era, with the widespread application of technologies such as big data, artificial intelligence, cloud computing, and blockchain, the financial markets have experienced what is known as a "quantitative revolution." Quantitative and algorithmic trading have increasingly become the prevailing trading models adopted by financial institutions.

Over the past half-century, numerous mathematicians have attempted to introduce intelligence and automation into investment practices. Research on quantitative methods began as early as the 1950s. However, due to the lack of robust database resources and computational tools, many ideas could not be implemented. This situation improved significantly following the internet revolution of the 1980s and the data explosion of the 1990s.

Hedge fund managers, represented by figures like Jim Simons, seized the opportunities brought by the digital technology revolution and initiated the "quantitative revolution." The rapid advancements in digital resources, artificial intelligence, and algorithmic technologies have driven a knowledge revolution and continuous improvements in investment methods. This, in turn, has triggered an exponential growth in data, coupled with the profit-driven nature of capital, leading to the continuous expansion of quantitative investing.

Against the backdrop of the global COVID-19 pandemic, the contradictions and issues accumulated over the past decade in the global economic and financial systems have become increasingly apparent. Real industries, consumer confidence, and social governance across various domains have faced comprehensive impacts. Meanwhile, international financial markets have experienced severe turbulence, with black swan events emerging one after another.

In the future, the global economy is highly likely to continue its downturn, with the worst-case scenario potentially leading to a prolonged depression. Previously, Bitcoin and its underlying blockchain technology, created in the aftermath of the global financial crisis, sparked a wave of innovation, reshaping perceptions of asset preservation and appreciation. Currently, the market generally agrees that mainstream cryptocurrencies have already dominated the market in terms of single-token market share, while derivative sectors based on digital currencies are experiencing explosive growth. The cryptocurrency quantitative financial market—an immense trillion-dollar blue ocean market—is now emerging.

Ordinary Investors

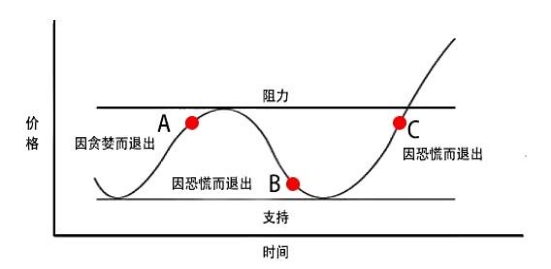

Ordinary investors, lacking access to effective investment tools, often fall victim to market fluctuations. Every retail investor, when facing returns and risks, may repeatedly swing between greed and fear, making investment decisions in isolation and without support. Similarly, every company that has embraced cryptocurrency financing, after experiencing the cycles of bull and bear markets, inevitably comes to realize—whether with relief or regret—that cryptocurrency asset management is critical to their financial health and even their survival.

Quantitative Investors

Most cryptocurrency investors, when competing against professional investment teams in the 24/7 non-stop cryptocurrency market, lack the investment expertise and quantitative tools of professional institutions. As a result, they are more inclined to entrust their capital to professional quantitative investment firms for management. With the rapid advancement of financial big data technology, quantitative investment funds, which leverage modern statistical and computer science methods to identify high-probability opportunities from massive datasets, have demonstrated unique advantages in navigating the ever-changing markets.

M1 Intelligent Custody Emerges in Response

The M1 AI Intelligent Quantitative Trading System is an intelligent trading platform independently developed and validated by M1 Digital LLC. It leverages advanced computing technologies such as artificial intelligence, blockchain technology, and big data to establish a decentralized management platform for financial trading.

The core algorithm of the M1 AI Intelligent Quantitative Trading System utilizes blockchain technology to facilitate globally decentralized financial transactions. This process aims to minimize subjective factors, reduce the impact of investor emotional fluctuations, and prevent irrational investment decisions during periods of market exuberance or pessimism.

Compared to traditional manual trading, the main features of M1 Intelligent Custody are as follows:

• Rapid Decision-Making and Execution: The M1-AI intelligent trading system can instantly analyze vast amounts of market data and execute pre-set trading strategies and rules without being influenced by emotions. It makes fast and accurate trading decisions, enabling quicker execution to seize market opportunities effectively.

• Data Analysis and Forecasting Capability: The M1-AI trading system boasts powerful data analysis and forecasting capabilities. It operates 24/7, performing deep learning and pattern recognition on historical data to predict future market trends and adjust trading strategies accordingly.

• Real-Time Monitoring of Data Trends: The AI system can instantly monitor market dynamics and quickly respond to real-time data with buy/sell actions. It promptly adjusts strategies to adapt to different market conditions and trading requirements.

The M1 AI Smart Quantitative Trading System is dedicated to building an effective digital asset financial system that can serve all social classes and the general public. At the same time, M1 Smart Custody has a comprehensive set of strategies, plans, and profit-generating measures designed to provide services to all members of society, especially vulnerable financial groups.

Last updated